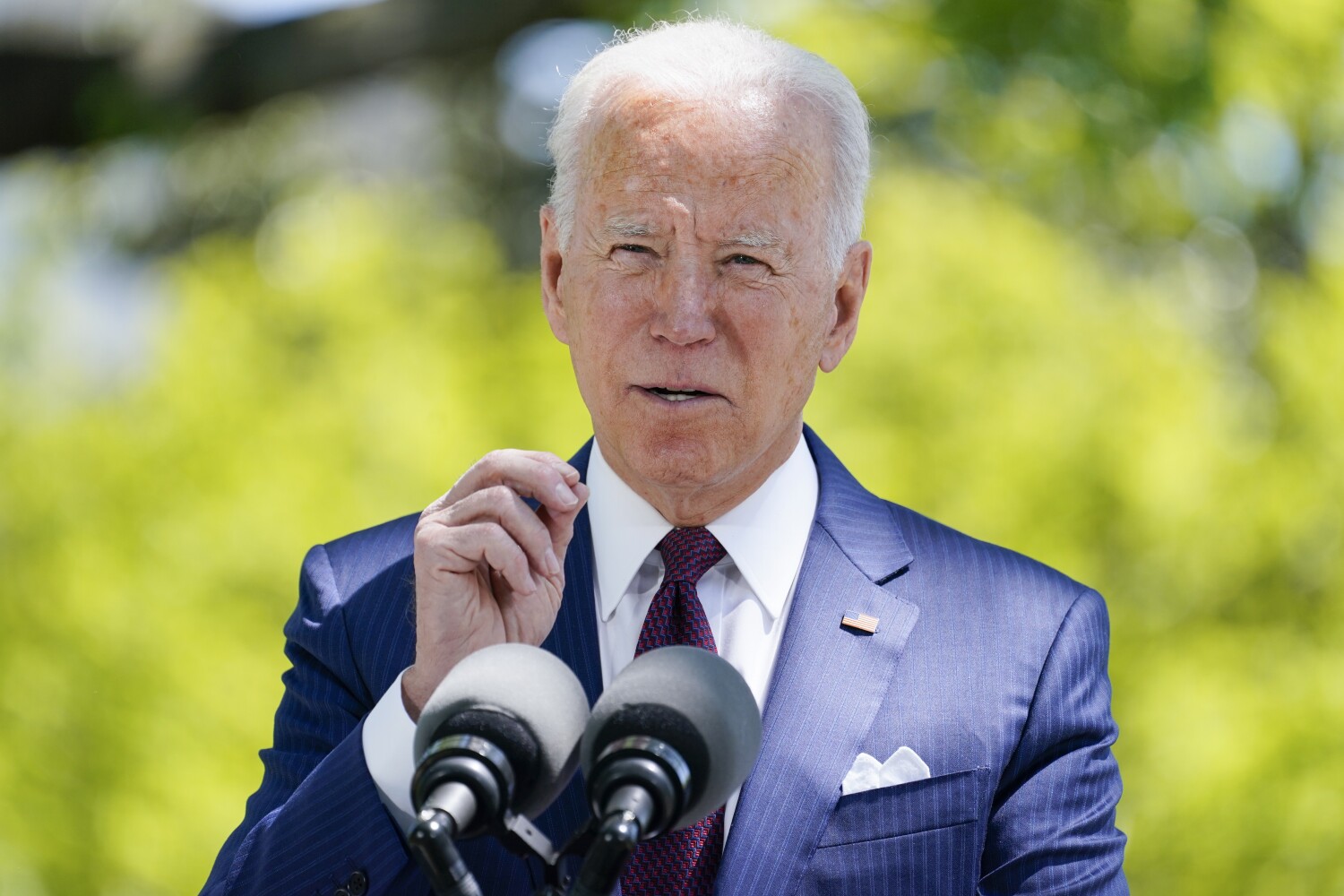

Biden’s ‘Families Plan’ would tax rich to help schools, child care, community college and more

[ad_1]

President Biden is proposing an ambitious $1.8-trillion, 10-year plan to subsidize American families’ education, child care, health insurance and job leave costs — an investment in workers intended to complement his earlier call for infrastructure spending and much more, to rebuild an economy hobbled by pandemic and economic inequality.

The “American Families Plan,” which Biden will describe in a prime-time address to a joint session of Congress on Wednesday, would subsidize two years of preschool and two years of community college for low- and middle-income families. It would also extend a number of tax credits and benefits to working families, while raising taxes on the wealthy to cover the costs.

Coming just weeks after his proposal to invest about $2 trillion in the nation’s deteriorating roads, bridges, airports and railways, it adds up to an over $4-trillion program in the coming decade — a Rooseveltian domestic policy agenda aimed at accelerating economic recovery and leveling the playing field.

The latest package would be paid for in part by turning back some Trump-era tax cuts for wealthy individuals, much like Biden’s call for higher corporate taxes to finance the infrastructure plans.

The two packages face GOP opposition, for both their costs and the proposed tax increases, but Republicans are especially likely to dismiss this new plan as a Democratic policy wish list.

The proposal includes an extension of the child tax credit that became law in March as part of Biden’s $1.9-trillion COVID-19 relief package and is projected to cut child poverty in half. It also would help low-income families afford quality child care, subsidize teacher training, invest more in historically Black colleges and universities, expand federal Pell grants for needy college students and provide a national system of paid family and medical job leave.

A senior administration official, who agreed Tuesday to outline the plan early on condition of anonymity, described the package as “generational investments in our future.”

Whereas Biden wants to fund his infrastructure proposal by raising the corporate tax rate to 28% from 21% — it was 35% before the Trump-era tax cuts — he wants to pay for the latest package of benefits for workers and families by reversing some of those 2017 tax cuts for the wealthiest 1% of Americans. The top individual tax rate would return to 39.6% from 37%, and Biden also would end some capital gains tax breaks and other loopholes that predominantly benefit the richest taxpayers.

Biden is also calling for more resources for the Internal Revenue Service, to allow it to perform more audits of tax returns and boost compliance. According to the White House, budget cuts caused the IRS to perform 80% fewer audits over the last decade on those making over $1 million a year. The administration estimated that better enforcement could raise $700 billion over 10 years in taxes that are now going unpaid.

“This is fundamentally about fairness in the tax code,” said another senior administration official.

Seeking buy-in from congressional Republicans, Biden stopped short of proposing to expand the estate tax. He also ignored calls, largely from Democrats, to do away with the cap on deductions for state and local taxes that was part of the Republicans’ tax law, and which disproportionately hits taxpayers in Democratic-led states.

White House officials called Biden’s proposal a “starting point” that outlines his priorities, and said the president is ready to negotiate with lawmakers in both parties. Yet the prospects for any bipartisan collaboration on such sweeping and progressive legislation appear dim at best.

With Democrats holding a slim majority in the House and controlling an evenly split Senate only due to Vice President Kamala Harris’ ability to break a tie, the path forward for the White House’s policy agenda is fraught with obstacles.

It’s possible some Republicans could support a compromise proposal to invest in traditional infrastructure projects. But Biden’s best shot to pass the American Families Plan may be through the process known as budget reconciliation, a maneuver that would rule out a Republican filibuster in the Senate and allow Democrats to pass the Biden bills with just 50 votes.

Overall, the proposal includes $1 trillion in new spending and $800 billion in tax cuts over the next decade. According to the White House, the proposed tax code changes that affect wealthier Americans would generate $1.5 trillion in revenue during the same period, enough to offset the new spending.

Biden and his aides, eager to seize what they see as a window of opportunity to enact a far-reaching domestic policy agenda, plan to emphasize the specific components of the proposal, first in the president’s nationally televised remarks Wednesday and then in his and Harris’ road trips in the days and weeks to follow.

With conservatives more animated by culture wars than policy debates, the administration is banking on broad public support and Americans’ greater appetite for government intervention and aid amid an unprecedented economic and health crisis.

Among the proposed benefits the White House will tout is an extension of the $3,000 per-child tax credit ($3,600 for a child under 5 years old) for all Americans earning less than $400,000 annually, which was included as a one-year provision in the earlier pandemic relief law. Also: a new, federally subsidized family and medical leave program providing workers up to $4,000 a month when they miss work for medical emergencies and major life events, replacing a minimum of two-thirds of average weekly wages; and an additional $1,400 in Pell grants for low-income college students.

Many of the policy proposals reflect the administration’s focus on issues of equity: subsidized tuition and greater investment in science, technology, engineering and math education at historically Black colleges; an expansion of programs offering free and reduced-cost lunches to low-income students; and incentives for people of color to go into education to alleviate teacher shortages.

Yet many of the benefits for working families have no income caps for eligibility. That would allow Americans who don’t need help paying for preschool or community college to rely on the government to cover their costs, too. But it reflects the administration’s thinking that near-universal benefits make for more popular programs, while upper-income beneficiaries will pay some costs in higher taxes.

The subsidy for child care, however, would only go to families earning up to 1.5 times their state median income. It would ensure that those families spend no more than 7% of their income on child care for children 5 years old and younger.

These benefits would result from proposed partnerships between Washington and the states, leaving open the possibility that Republican-led states might refuse to take part — as was the case in recent years when some Republican states opted not to accept federal funds to expand Medicaid under President Obama’s Affordable Care Act. Biden administration officials said they had other ways to deliver benefits in such a scenario.

[ad_2]

Source link